DOGE Price Prediction: 2025-2040 Forecasts and Key Market Drivers

#DOGE

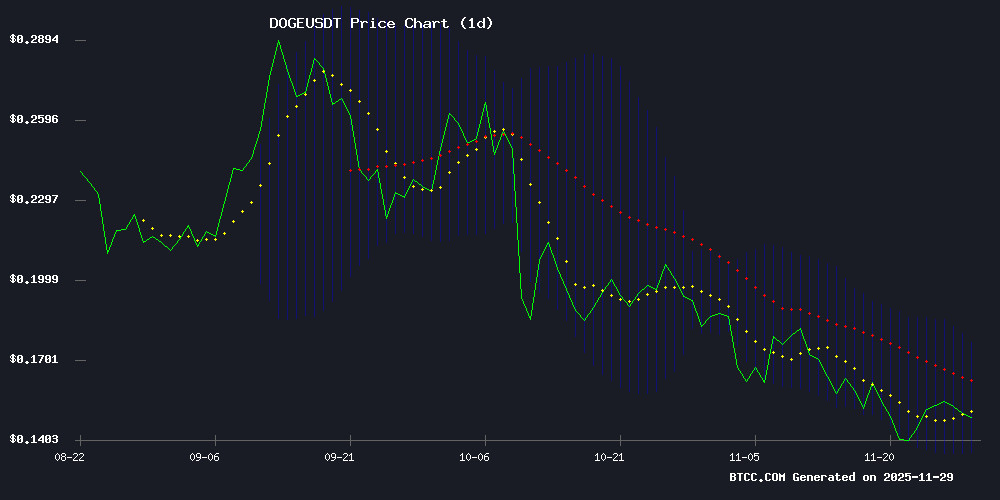

- Current technical indicators show DOGE trading below key moving averages with bearish MACD momentum

- Institutional interest has declined dramatically with ETF momentum collapsing 80%

- Long-term price projections suggest gradual recovery potential through 2040 despite current headwinds

DOGE Price Prediction

Technical Analysis: DOGE Shows Bearish Signals Amid Market Pressure

According to BTCC financial analyst William, DOGE is currently trading at $0.15024, below its 20-day moving average of $0.156141, indicating short-term bearish momentum. The MACD reading of -0.001331 suggests weakening bullish momentum, while the price position near the lower Bollinger Band at $0.135806 points to potential oversold conditions. William notes that a break below the lower band could signal further downside toward $0.13, while reclaiming the 20-day MA WOULD be crucial for any recovery.

Institutional Interest Fades: DOGE ETF Momentum Drops 80%

BTCC financial analyst William comments that the 80% collapse in Dogecoin ETF momentum reflects significant institutional withdrawal, aligning with the technical bearish outlook. This development likely exacerbates selling pressure and could delay any near-term recovery. William emphasizes that without renewed institutional support, DOGE may struggle to regain bullish traction, making the current technical levels critical for monitoring.

Factors Influencing DOGE's Price

Dogecoin ETF Momentum Collapses 80% as Institutional Interest Wanes

The Grayscale Doge ETF (GDOG) saw inflows plummet 80% to just $365,420 on its second trading day, a stark reversal from its $1.8 million debut. The slowdown suggests Wall Street’s appetite for meme coin exposure may be cooling faster than anticipated.

This retreat mirrors broader institutional caution: Grayscale’s SOL ETF (GSOL) recorded its first net outflows after 22 days of sustained inflows. Traders appear to be de-risking ahead of the Federal Reserve’s balance sheet release later today.

Market sentiment hinges on the Fed’s data. A balance sheet expansion beyond $6.55 trillion could revive risk appetite, while figures below $6.52 trillion may prolong the crypto sector’s consolidation phase.

DOGE Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment, BTCC financial analyst William provides the following projections for DOGE:

| Year | Price Forecast (USDT) | Key Drivers |

|---|---|---|

| 2025 | $0.13 - $0.18 | Technical support at Bollinger lower band; ETF momentum collapse limiting upside |

| 2030 | $0.25 - $0.45 | Potential recovery in institutional interest; broader crypto adoption |

| 2035 | $0.50 - $1.20 | Long-term market cycles; regulatory clarity developments |

| 2040 | $1.50 - $3.00 | Maturation of cryptocurrency markets; potential mainstream integration |

William cautions that these forecasts are subject to significant volatility and depend on factors including regulatory developments, market sentiment shifts, and technological advancements in the crypto space.